Table of contents

TL;DR

VC and PE firms can’t rely on generic design. LPs expect clarity, consistency, and investor-grade storytelling. Specialized presentation partners translate complex fund data into decision-ready decks that build trust fast.

VC and PE firms can’t rely on generic design. LPs expect clarity, consistency, and investor-grade storytelling. Specialized presentation partners translate complex fund data into decision-ready decks that build trust fast.

Amélie Laurent

Product Manager, Sisyphus

Every quarter, venture capital and private equity leaders step into rooms where billions in capital depend on clarity, confidence, and conviction.

But even the most promising funds can lose momentum when their story gets buried in dense slides and disconnected visuals.

Today’s LPs scan faster, question harder, and expect consistency across every touchpoint with logical slides, numbers on-point, and strong narrative. They want to see a fund’s evolution, conviction, and direction at a glance.

That’s why leading VC and PE firms don’t rely on generic design support. They partner with specialized presentation agencies that:

- Understands how LPs and boards interpret structure, tone, and data.

- Simplify complexity by turning fund performance and strategy into clear, decision-ready stories.

- Build scalable presentation systems with branded master templates and visual frameworks

- Operates as an extension of your in-house team to deliver high-stakes presentations with precision, speed, and reliability.

In this guide, we’ll cover why VC and PE firms need specialized presentation partners, what top-tier agencies bring beyond design execution, and how to evaluate the right fit.

What Makes VC & PE Presentations So High-Stakes?

When you’re in front of LPs, portfolio founders, board, or internal partners, every slide signals how well your team understands its own story. A missed detail, inconsistent chart, or unclear data flow raises questions about discipline and diligence.

Here’s why VC & PE presentations operate at a higher standard:

Decisions depend on clarity.

LPs make fund allocation choices worth millions based on how well a fund’s story and performance are presented.

Decisions happen fast.

LPs form an opinion within minutes. The first five slides often define how credible your entire fund feels.

Complex data requires translation.

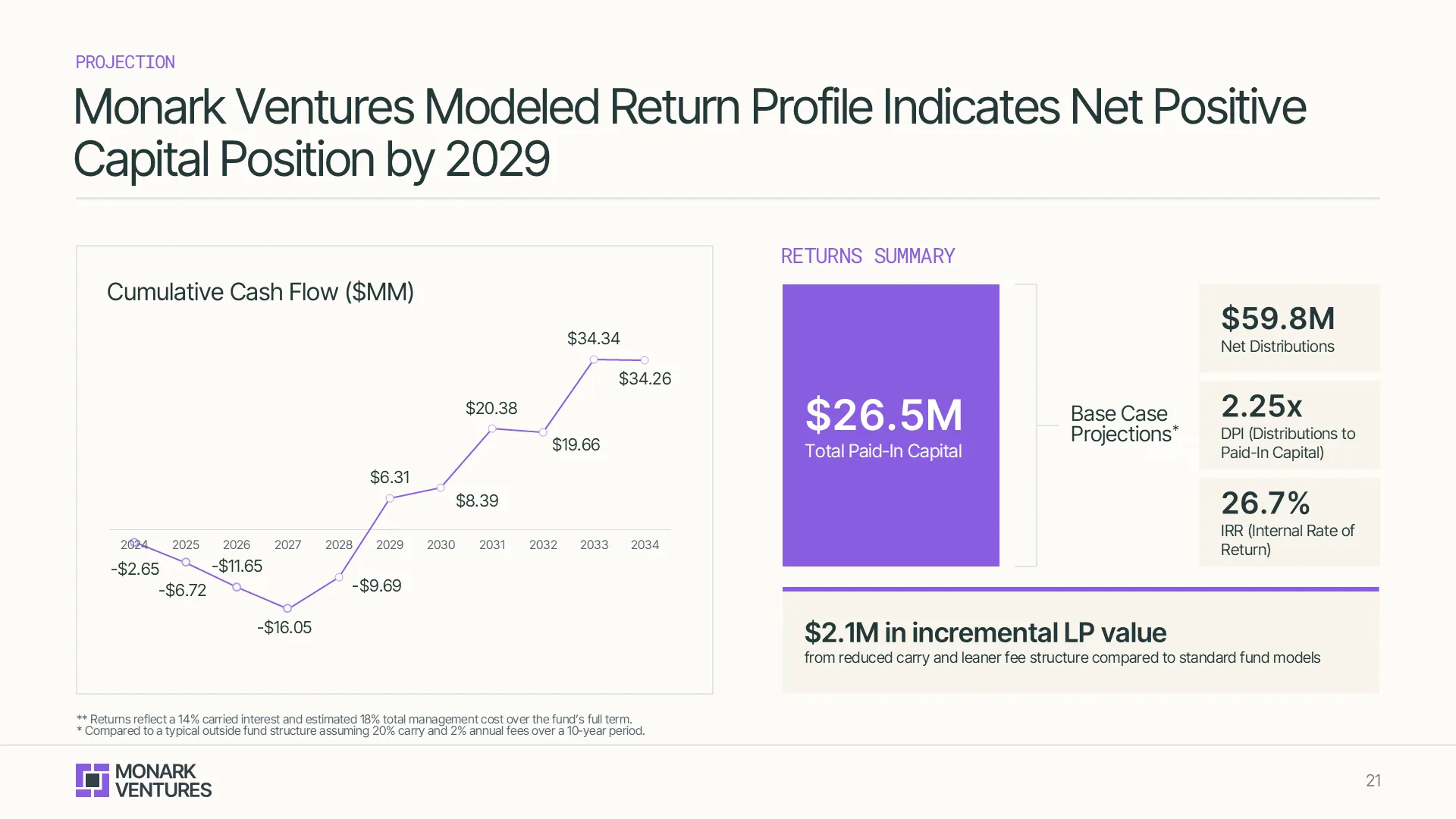

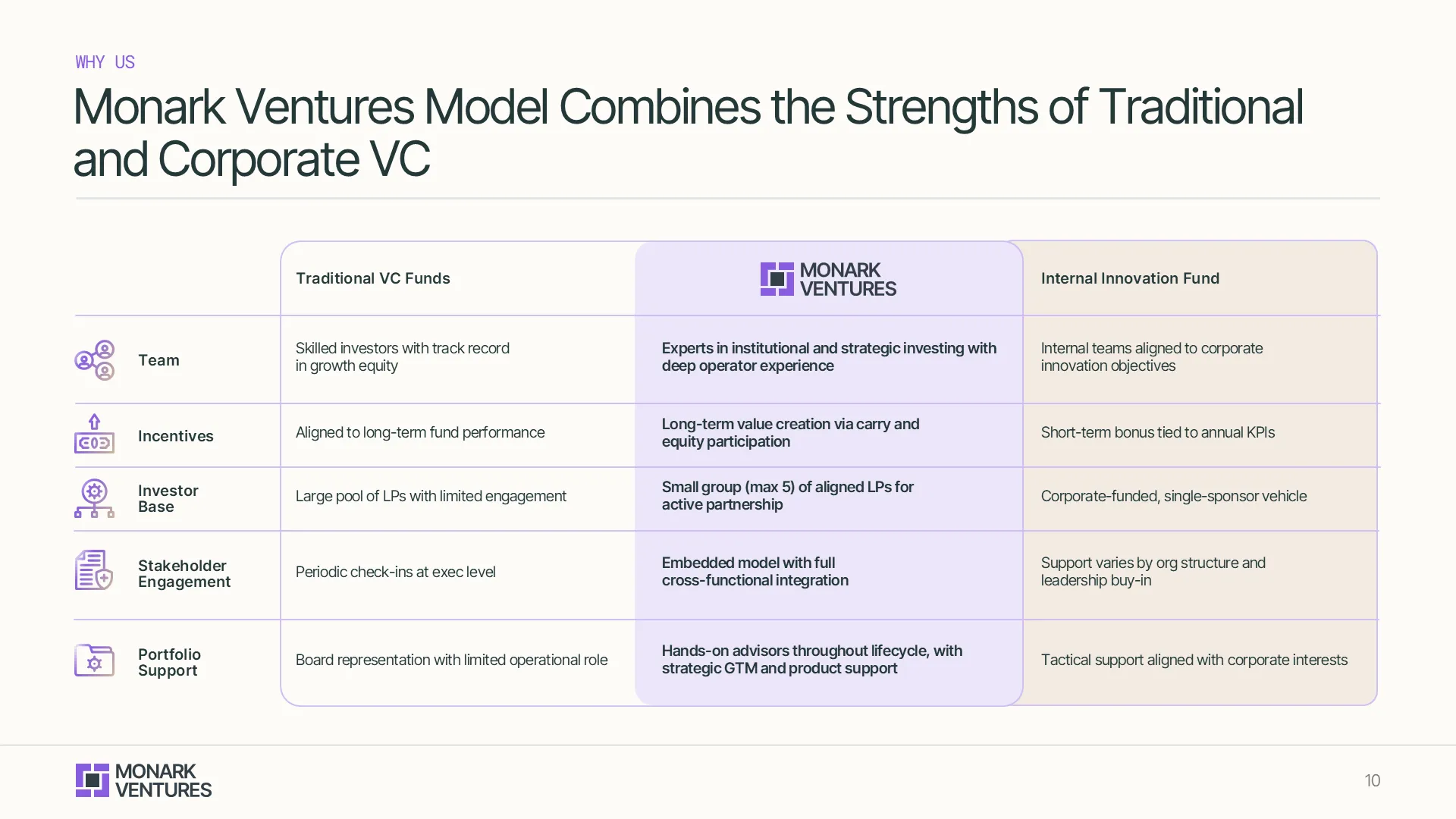

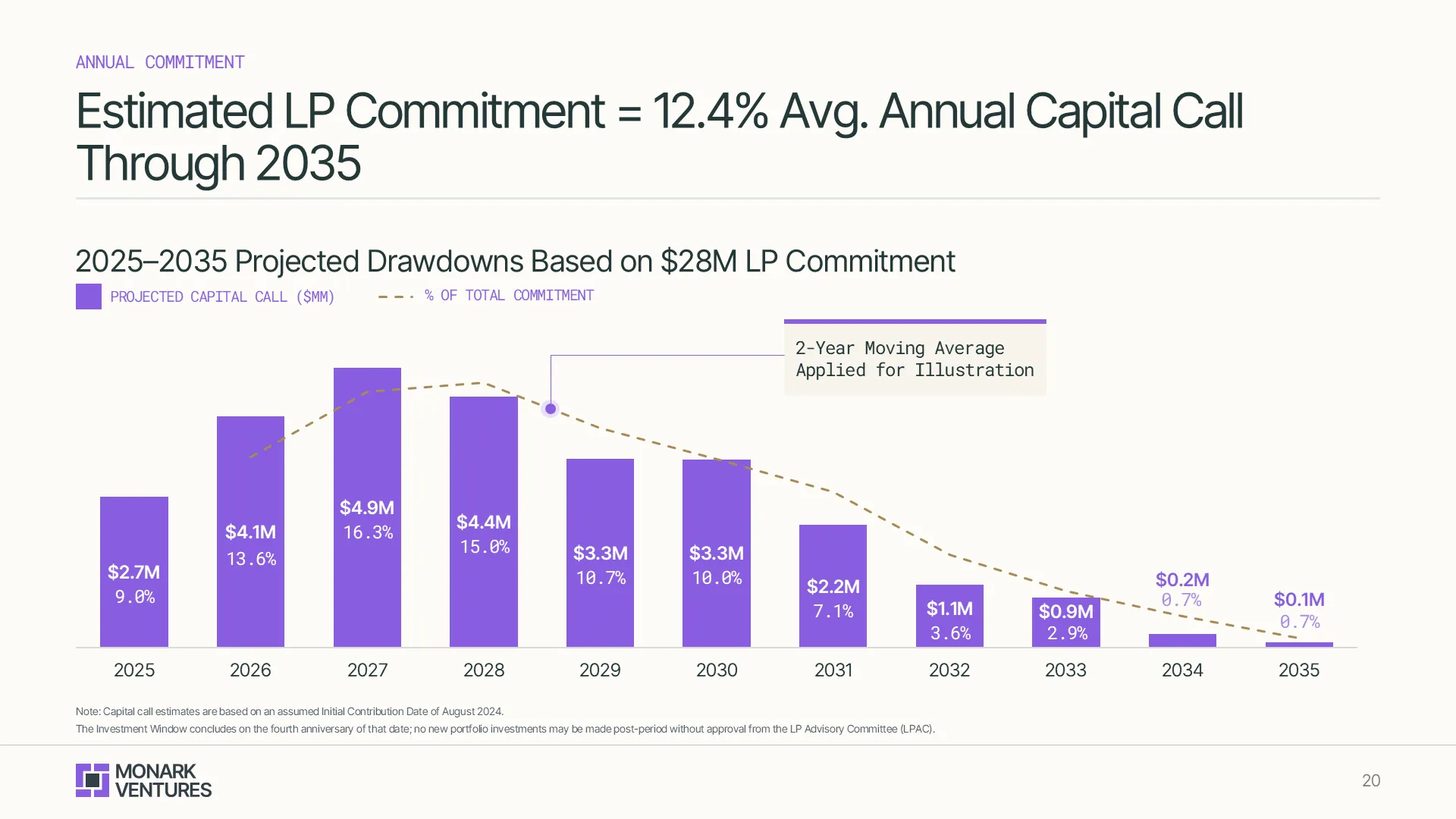

Metrics like DPI, TVPI, and MOIC mean little without context. A specialized presentation design expert helps turn those numbers into a story of progress and performance.

Different rooms, different expectations.

LPs want transparency. Boards want accountability. Founders want direction. The best decks adapt effortlessly to all three.

Internal alignment matters too.

Beyond LPs, your team, partners, and advisors all rely on presentation clarity to stay on the same page.

This is why presentation design matters. It simplifies what’s complex, accelerates decisions, and builds the trust that fuels growth.

The Difference Between a Generic Design Firm and a Specialized VC/PE-Focused Presentation Design Partner

Investor presentations operate in a different league. The stakes are higher, the scrutiny is sharper, and the expectation of precision is non-negotiable.

That’s why presentation partners who understand fund language, not just design language, make all the difference.

A VC & PE-focused presentation design agency designs for how LPs think. It’s about connecting data, discipline, and design into one cohesive story that withstands investor questions.

Case Study

Client: Early-stage corporate venture capital platform

POC: Sarah, Head of Investor Relations

Engagement: Ongoing retainer, starting with Fund I presentation and scaling into LP updates and board decks

When Sarah joined her firm’s IR team, the fund was preparing to raise its first institutional capital. The content was ready, performance metrics, portfolio breakdowns, and a clear investment thesis. But the deck looked and felt inconsistent.

She hired a generic design firm to improve the presentations. The slides looked modern, but lacked intention.

- Charts were redesigned without understanding what LPs look for

- Data-heavy slides were visually cluttered

- Important story transitions, from strategy to results, were lost in layout noise

Each iteration required multiple rounds of revision because the designers didn’t understand financial logic, investor flow, or fund-level storytelling.

The Outcome

A beautiful presentation that still left LPs confused.

M’idea Hub’s Approach

When Sarah partnered with M’idea Hub, the goal shifted from making slides look good to making the story work.

We approached it as an extension of their team. With our multidisciplinary team, all with experience working with 70+ VC and PE firms, we:

- We rebuilt core slides to set up logical flow & structure: Thesis → Team → Track Record → Portfolio → Strategy.

- Used data storytelling, making DPI, TVPI, and MOIC effortless to interpret.

- Crafted a strong moodboard using clean typography, gradient patterns, and refined iconography. Ensured every slide is on-brand.

The Outcome

- Revision cycles were cut in half, allowing Sarah’s team to focus on messaging and relationship-building.

- The collaboration evolved into a long-term retainer, positioning M’idea Hub as the firm’s strategic design and communication partner.

- The team has since executed 12+ major deliverables with M’idea Hub under an ongoing retainer with zero missed deadlines.

View our VC & PE Portfolio to see how we’ve helped top firms elevate their investor presentations.

10 Presentations You’ll Need Across the Year as a Emerging VC/PE Firm

For most VC and PE firms, presentation design isn’t a one-time need; it’s a continuous cycle.

Across fundraising, reporting, and governance, each deck serves a specific purpose in maintaining trust, communicating progress, and reinforcing institutional credibility.

When handled by a specialized partner, design becomes more than a support function; it becomes a communication system that scales across every audience: LPs, boards, partners, and portfolio founders.

Here are the 10 presentations every fund needs every year:

Key Takeaways

Every slide a fund shares with LPs, boards, or founders reflects how disciplined, credible, and forward-thinking that firm really is.

The best VC and PE leaders already know this. They treat presentation design as a core part of their system, a tool for shaping perception, building trust, and accelerating conviction.

At M’idea Hub, we help firms do exactly that.

We’ve designed 500+ presentations for 70+ leading venture capital and private equity firms, crafting everything from fundraising decks and LP updates to AGM and board presentations.

Our work extends beyond them, we support their portfolio companies with investor decks, product presentations, and strategy materials.

Our multidisciplinary team bridges the gap between financial storytelling and design intelligence, building scalable systems that keep every fund, update, and founder presentation consistent, on-brand, and investor-ready.

Book a Discovery Call to see how M’idea Hub helps VC and PE firms and their portfolio companies, communicate with the clarity that builds trust.

Frequently Asked Questions

1. What are the most common mistakes emerging funds make with their decks?

- Leading with numbers before context

- Overloading slides with text instead of guiding the narrative visually

- Inconsistent formatting across LP updates, board decks, and AGMs

- Treating design as a cosmetic layer instead of a communication system

2. How can specialized design help during AGM or LP updates?

AGMs and LP updates are high-stakes moments where every visual choice counts.

A specialized design partner ensures your decks has,

- Engaging narrative, guiding the audience through the fund’s story, performance, and outlook

- Logical flow, allowing the presentation to flow seamlessly from performance data to strategic direction

- Consistent visuals and design logic that make complex metrics easy to follow

With M’idea Hub, your presentations will not only meet investor expectations but also reinforce your fund’s maturity and discipline.

3. What makes M’idea Hub different from other presentation design agencies?

M’idea Hub is built for high-stakes communication; where LPs, boards, and partners make decisions based on how clearly your story is told. With experience across 50+ VC & PE firms and 700+ decks delivered, we blend design precision with investor logic, ensuring every slide reinforces credibility, clarity, and confidence.

4. What does the collaboration process look like?

We work as an extension of your internal team from start to finish. Here’s what the process looks like, from kickoff to delivery:

- We review your existing materials and brand system

- Our expert presentation designers restructure the fund's narrative to ensure clear communication

- We simplify complex fund metrics into impactful visuals

- We build scalable, reusable templates for all future presentations, keeping your fund’s communications consistent across updates and new raises

Throughout the process, you’ll see real-time progress with milestone-based reviews and zero missed deadlines.

5. Can M’idea Hub support ongoing presentation needs, not just one project?

Absolutely.

Most of our VC and PE clients start with a flagship project (e.g., Fund I deck) and then transition to ongoing retainers for quarterly LP updates, AGM decks, and portfolio company decks. Our goal is to create a design system that scales with your fund, ensuring consistency, clarity, and investor-ready quality across every communication.

6. How much does presentation design for private market firms typically cost?

For institutional-grade presentations, our fees generally range from $8,000–$15,000, depending on scope, data complexity, and timeline.

For ongoing retainers (quarterly updates, board decks, LP updates), we tailor engagement models that fit your fund’s lifecycle and reporting calendar.

7. Can you help our portfolio companies with their presentations?

Yes. We often support portfolio companies with fundraising decks, strategy updates, and product presentations, ensuring their materials reflect the same storytelling and design standards as the fund itself. This creates consistency and elevates your firm’s overall brand presence in every investor room.